Projecting Medicare Advantage Enrollment: Expect the Unexpected?

While much of the health policy world is focused on the health coverage developments in store as the Affordable Care Act of 2010 (ACA) is implemented, private insurers are also gearing up for the next Medicare Advantage open enrollment season. Four months from now, just as exchange enrollment swings into action, Medicare beneficiaries will have the option to enroll in a Medicare Advantage plan (or switch plans) during the annual open enrollment period. And, earlier this month, each of the insurers participating in the Medicare Advantage program submitted what is known as a “bid” to the federal government that essentially indicates whether they will offer more or fewer Medicare Advantage plans in 2014 than in 2013 and how they will change their plans’ benefits and premiums, which could ultimately affect how many Medicare beneficiaries enroll in Medicare Advantage plans in 2014 and future years.

During the debate about the ACA, there was much discussion about whether and to what extent reductions in federal payments to Medicare Advantage plans would affect seniors. Some questioned whether plans would pull out of markets across the country leading to a drop in Medicare Advantage enrollment, as occurred after Congress reduced payments for Medicare plans as part of the Balanced Budget Act (BBA) of 1997 (see Exhibit 1).

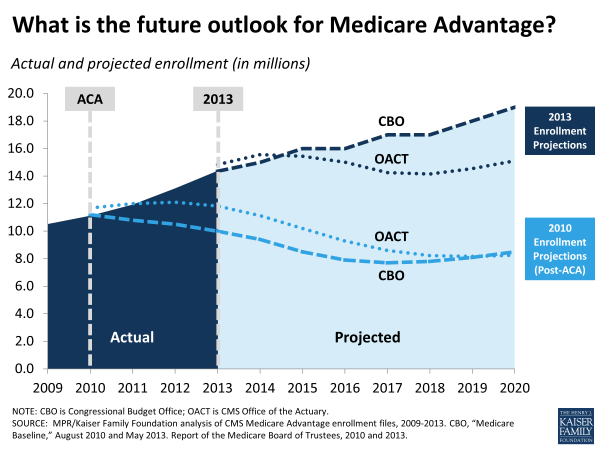

The ACA reduced federal payments to Medicare Advantage plans in response to concerns about overpayments to plans, bringing payments more in line with costs under traditional Medicare, while also making bonus payments to plans with high quality ratings. The Congressional Budget Office (CBO), the Centers for Medicare and Medicaid Services (CMS) Office of the Actuary (OACT), and America’s Health Insurance Plans (AHIP) projected that Medicare Advantage enrollment would sharply decline, resulting in fewer Medicare Advantage enrollees nationwide than CBO previously projected in 2009, and as many as 7 million fewer Medicare Advantage enrollees in 2019. In 2011, CMS announced a demonstration to expand the size and scope of the quality-based bonus payments for 2012 through 2014.

Despite predictions that enrollment would drop, enrollment in Medicare Advantage plans has actually climbed from 11.1 million in 2010 to 14.4 million in 2013 – a 30 percent increase. The CBO, OACT, and industry financial analysts have revised their enrollment projections and expect enrollment in Medicare Advantage plans to continue to grow in 2014, after which, their projections differ. The CBO projects Medicare Advantage enrollment will continue to grow slowly through 2022, while the OACT projects that enrollment will decline between 2015 through 2018, and then climb upward for the next several years.

It is not entirely clear why enrollment has continued to climb since 2010, or if the trend will continue at the current clip. Analysts believe that the bonus payments have certainly helped to mitigate the effects of payment reductions, and that plans appear to be doing more to reduce their costs. Some speculate that Medicare Advantage plans are benefitting from the slowdown in medical spending, enabling them to keep premiums low. Others ascribe the growth in enrollment to the influx of baby boomers who may have greater comfort with managed care plans than previous generations. As additional payment reductions are phased in over the next few years, the growth in enrollment could stall or even reverse, if plans pull out of the market because they feel they cannot operate profitably. Even if enrollment continues to increase, there is some speculation that plans may scale back benefits and/or increase cost-sharing in response to reductions in Medicare payments and the soon-to-be implemented annual fee on health insurance that was enacted in the ACA, which also applies to Medicare Advantage.

The full explanation is likely to be more nuanced than our current understanding, but it is clear that past predictions are not panning out. For now, this chart provides a cautionary tale for even our best efforts to predict the future.