President Trump’s 2018 Budget Proposal Reduces Federal Funding for Coverage of Children in Medicaid and CHIP

Medicaid and the Children’s Health Insurance Program (CHIP) are key sources of coverage for children, covering nearly four in ten children (39%) nationwide1 and 44% of children with special health care needs. Medicaid covered over 37 million children in FY2016.2 CHIP serves as an important complement to Medicaid. In FY2016, it covered about 9 million children in families who earn too much to qualify for Medicaid but often lack access to affordable private coverage.3 States provide CHIP by creating a separate CHIP program, expanding Medicaid, or adopting a combination approach. All states have expanded eligibility for children through Medicaid and CHIP (Figure 1). New legislative authority is needed to continue CHIP funding beyond September 2017. If Congress does not extend CHIP funding, it is estimated that all states will exhaust their federal CHIP funds during FY2018.4

President Trump’s FY2018 proposed budget includes fundamental changes to Medicaid that would transition federal financing to a block grant or per capita cap for children and other groups, with reductions in federal funding of $610 billion. These changes are in addition to eliminating enhanced federal funding for the Affordable Care Act (ACA) Medicaid expansion to low-income adults. While the budget does not include many details, the provisions in the American Health Care Act (AHCA) would allow states to impose a block grant or per capita cap for children in Medicaid with requirements to cover mandatory children (under 100% of the federal poverty level (FPL) for school age children and under 133% FPL for children ages 0-5). Under the block grant option, states could cap enrollment or impose waiting lists for children above minimum levels and would not be required to provide comprehensive benefits.

The proposed budget also would reduce federal funding under CHIP and cap the eligibility level for which states could receive federal funding for children’s coverage at 250% FPL. The budget proposes to extend CHIP funding for two years through FY2019. However, it proposes several changes to CHIP. It would eliminate the 23 percentage point increase in the federal match that was provided to states under the Affordable Care Act (ACA), which would reduce funding for states. It also would cap the eligibility level for which states could receive federal CHIP matching funds at 250% FPL. In addition, it would eliminate the maintenance of effort requirement that the ACA established to protect existing coverage gains for children. This provision requires states to keep Medicaid and CHIP eligibility levels at least as high as those they had in place at the time the ACA was enacted through September 30, 2019. Lastly, it would allow states to move children ages 6 to 18 with incomes between 100% and 133% FPL who were transitioned from CHIP to Medicaid under the ACA back to CHIP. These changes would result in net saving in CHIP of $5.8 billion over ten years.

Under the proposed budget, about half of states would lose federal matching funds for children due to the 250% FPL eligibility cap on federal matching funds, which would likely lead them to reduce eligibility for children. As of January 2017, 24 states, including DC, have Medicaid/CHIP income eligibility limits above 250% FPL, including 19 states that cover children at or above 300% FPL (Table 1). These states would lose access to federal matching funds for coverage of children with incomes above 250% FPL under the proposed changes, which would increase state costs and likely lead to states reducing eligibility for children. In addition, states could further reduce children’s eligibility to the minimum levels (100% FPL for children ages 6 to 18 and 133% FPL for children ages 0-5) since the maintenance of effort provision would no longer apply.

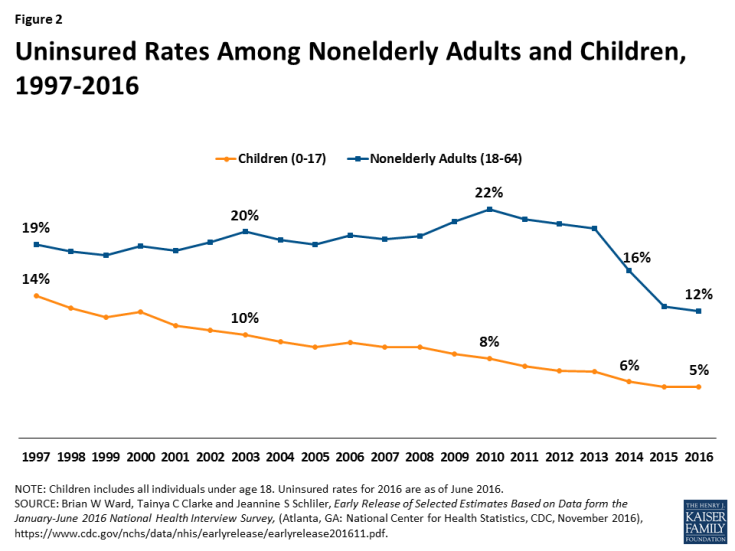

Together, the proposed changes to Medicaid and CHIP would result in significant reductions in federal financing for children’s coverage. In response to these reductions, states will likely need to make program cutbacks, including reductions in eligibility and benefits. Such reductions would likely reverse the recent progress achieved in making affordable coverage available to working families and reducing the children’s uninsured rate to a record low of 5% (Figure 2). Coverage losses among children would lead to reduced access to care and other long-term negative effects for children and increase financial pressure on states and providers.

| Table 1: Upper Medicaid/CHIP Income Eligibility Limits for Children as a Percent of the Federal Poverty Level (FPL), January 2017 | ||

| State | Upper Medicaid/CHIP Income Limit | |

| Without Income Disregard | With Income Disregard1 | |

| Median | 250% | 255% |

| Alabama | 312% | 317% |

| Alaska | 203% | 208% |

| Arizona | 200% | 205% |

| Arkansas | 211% | 216% |

| California | 261% | 266% |

| Colorado | 260% | 265% |

| Connecticut | 318% | 323% |

| Delaware | 212% | 217% |

| District of Columbia | 319% | 324% |

| Florida | 210% | 215% |

| Georgia | 247% | 252% |

| Hawaii | 308% | 313% |

| Idaho | 185% | 190% |

| Illinois | 313% | 318% |

| Indiana2 | 250% | 262% |

| Iowa | 302% | 307% |

| Kansas | 239% | 244% |

| Kentucky | 213% | 218% |

| Louisiana | 250% | 255% |

| Maine | 208% | 213% |

| Maryland | 317% | 322% |

| Massachusetts | 300% | 305% |

| Michigan | 212% | 217% |

| Minnesota | 283% | 288% |

| Mississippi | 209% | 214% |

| Missouri | 300% | 305% |

| Montana | 261% | 266% |

| Nebraska | 213% | 218% |

| Nevada | 200% | 205% |

| New Hampshire | 318% | 323% |

| New Jersey | 350% | 355% |

| New Mexico | 300% | 305% |

| New York | 400% | 405% |

| North Carolina | 211% | 216% |

| North Dakota | 170% | 175% |

| Ohio | 206% | 211% |

| Oklahoma | 205% | 210% |

| Oregon | 300% | 305% |

| Pennsylvania | 314% | 319% |

| Rhode Island | 261% | 266% |

| South Carolina | 208% | 213% |

| South Dakota | 204% | 209% |

| Tennessee | 250% | 255% |

| Texas | 201% | 206% |

| Utah | 200% | 205% |

| Vermont | 312% | 317% |

| Virginia | 200% | 205% |

| Washington | 312% | 317% |

| West Virginia | 300% | 305% |

| Wisconsin | 301% | 306% |

| Wyoming | 200% | 205% |

| SOURCE: Based on a national survey conducted by the Kaiser Commission on Medicaid and the Uninsured with the Georgetown University Center for Children and Families, 2017. 1 Modified Adjusted Gross Income rules include an income disregard equal to five percentage points of the federal poverty level applied at the highest income level for Medicaid and separate CHIP coverage. 2 Indiana uses a state-specific income disregard equal to five percent of the highest income eligiblity threshold for the group. |

||

Endnotes

Kaiser Family Foundation analysis of the 2016 Annual Social and Economic Supplement to the Current Population Survey.

Centers for Medicare & Medicaid Services (CMS), FFY 2016 Number of Children Ever-Enrolled in Medicaid and CHIP, (Baltimore, MD: CMS, May 2016, https://www.medicaid.gov/chip/downloads/fy-2016-childrens-enrollment-report.pdf.

Ibid.

Medicaid and CHIP Payment and Access Commission (MACPAC), Federal CHIP Funding: When Will States Exhaust Allotments?, (Washington, DC: MACPAC, March 2017), https://www.macpac.gov/publication/federal-chip-funding-when-will-states-exhaust-allotments/